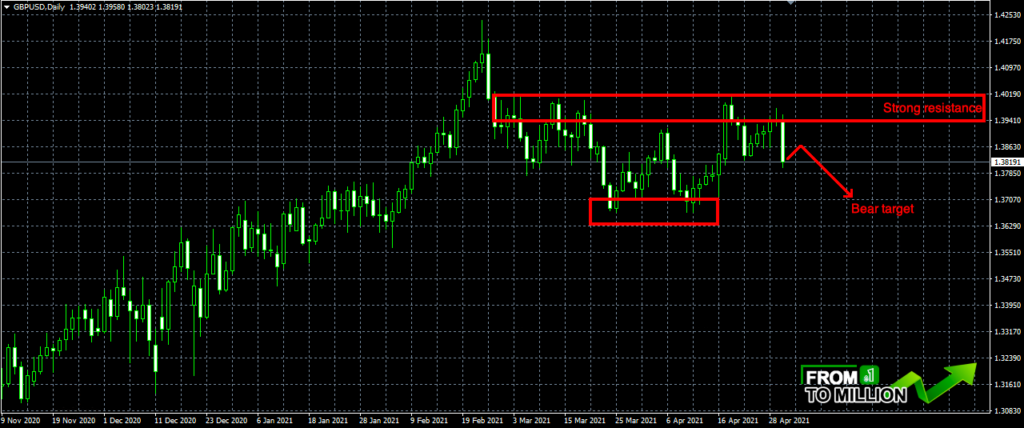

Not much has changed this week, dollar bulls keep fighting over 90 and again won the fight and defended the strong support. Two fridays in a row, London fix was in favor of dollar bulls into next week, but I am still waiting for a the strong upmove, without much of correction on the way. FED keeps talking about tapering, everyone is talking about insane inflation, so to me its just a waiting game, even though its frustrating. But everytime before a reversal, there is a lot of tight range play, frustrating for swing traders. If we look at all the main USD related pairs, in every one of them a strong reversal or correction is just waiting to happen. Even USDJPY, which is sitting below 110 and looks like a good short, would be a very dangerous short, looking at the weekly chart setup. 110 is a big psychological barrier…but it still feels like its going to break next week…and the area between 111-112.50 might be tested. That area might be a good short, but only if it holds…if not and it breaks, there is a lot of room to the upside. Even USDCAD looks like a perfect long setup, even though I don’t trade CAD, as its too risky. But its painting a picture towards other pairs, so it might be useful. When it comes to EURUSD, 2200 is the equivalent of 90 on USDx…and it is a strong barrier, where many fights happened this week. Once the fight is over, we will see who wins…